Table of Contents

- Anticipation builds for US July CPI report: Expert expectations - Sharecafe

- CHART OF THE DAY: CPI-PPI Divergence

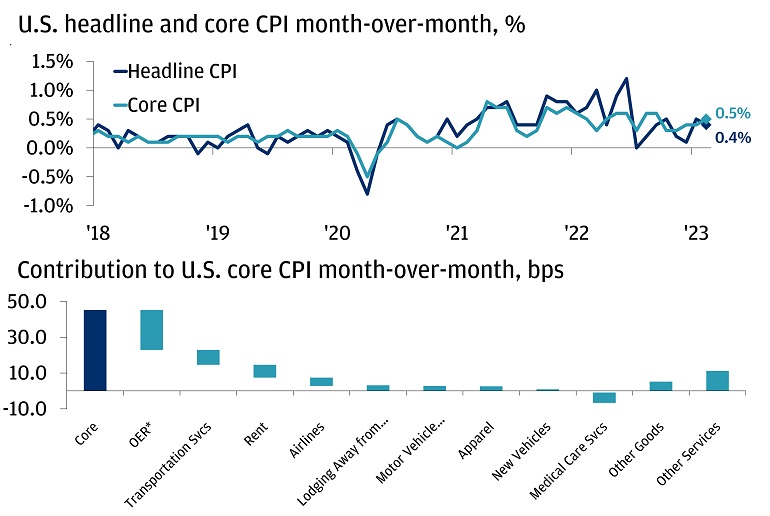

- Quick shot: The February CPI print: In-line, but still too hot

- Consumer prices rose 6.5% in December as Fed mulls next rate hike

- Cpi Data Usa - Ignacio King Berita

- Consumer Price Index: Tujuan, Jenis, Contoh dan Cara Mengukurnya

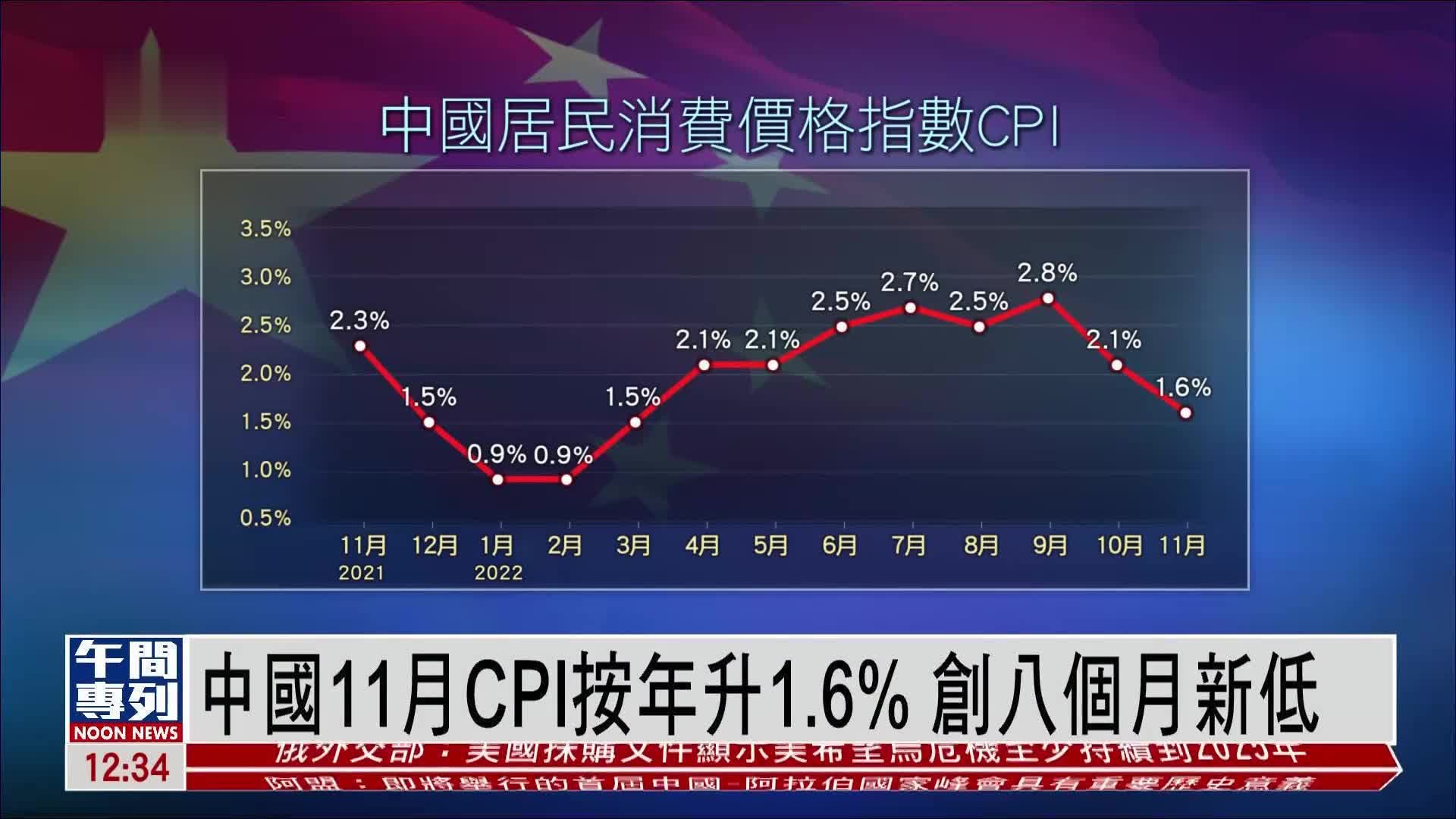

- 中国11月CPI按年升1.6% 创八个月新低_凤凰网视频_凤凰网

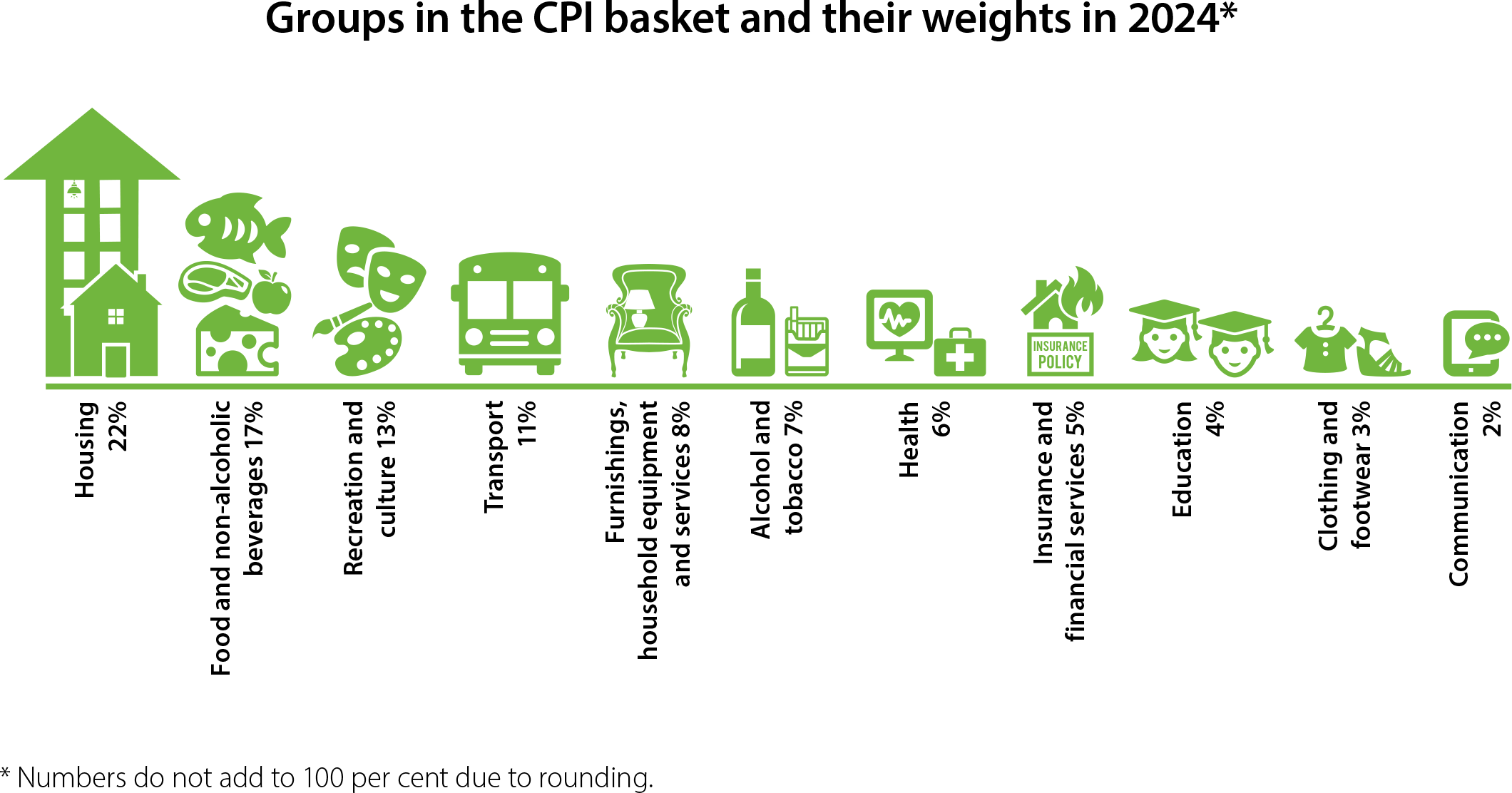

- What's your real inflation rate? - Morningstar.com.au

- Không thể chủ quan dù CPI tháng 8 được "hãm phanh", mục tiêu kiểm soát ...

- 物聯網應用實例 - BTCC 熱門知識

What is the Consumer Price Index (CPI)?

How is the CPI Calculated?

What does the CPI Indicate?

The CPI is a key indicator of inflation, which is a sustained increase in the general price level of goods and services in an economy. A high CPI reading indicates a high level of inflation, while a low reading indicates low inflation. The CPI also helps policymakers to: Monitor inflation: CPI data helps central banks and governments to monitor inflation and adjust monetary and fiscal policies accordingly. Adjust interest rates: Changes in CPI can influence interest rate decisions, as high inflation may lead to higher interest rates to curb borrowing and spending. Make informed investment decisions: Investors use CPI data to make informed decisions about investments, such as bonds, stocks, and commodities.

Importance of CPI in Economic Decision-Making

The CPI plays a crucial role in economic decision-making, as it: Helps to adjust wages and pensions: CPI data is used to adjust wages and pensions to keep pace with inflation. Influences business decisions: Companies use CPI data to make decisions about pricing, production, and investment. Guides fiscal policy: Governments use CPI data to guide fiscal policy decisions, such as taxation and government spending. In conclusion, the Consumer Price Index is a vital economic indicator that provides insights into the level of inflation in an economy. Understanding the CPI is essential for policymakers, investors, and consumers to make informed decisions about investments, spending, and savings. By tracking the CPI, individuals can stay ahead of the curve and navigate the complexities of the economy.Source: Investopedia

Note: The article is written in a SEO-friendly format with relevant keywords, meta title, and header tags to improve search engine ranking. The word count is approximately 500 words.